All Categories

Featured

Table of Contents

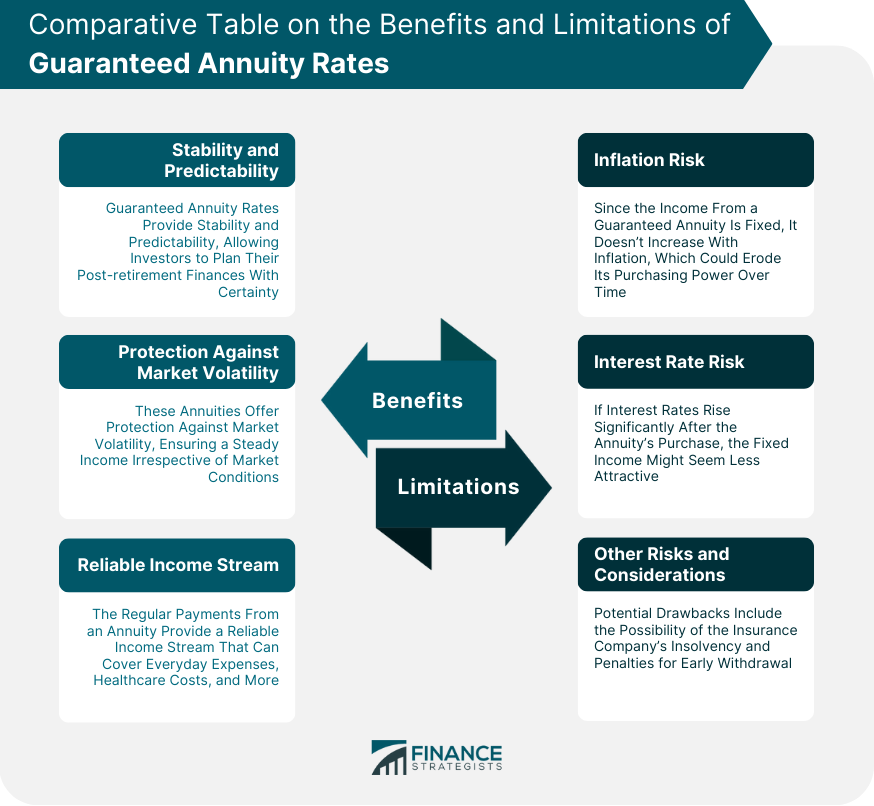

You can make a partial withdrawal if you require extra funds. In enhancement, your account value remains to be maintained and attributed with current rate of interest or investment incomes. Obviously, by taking periodic or systematic withdrawals you risk of depleting your account value and outliving the agreement's built up funds.

In many contracts, the minimal rate of interest price is evaluated issue, but some contracts allow the minimal price to be adjusted occasionally. Excess passion contracts provide adaptability with respect to costs repayments (single or adaptable). For excess passion annuities, the maximum withdrawal fee (also called a surrender charge) is covered at 10%.

A market value modification readjusts an agreement's account value on surrender or withdrawal to reflect adjustments in rate of interest because the receipt of contract funds and the continuing to be duration of the rate of interest warranty. The adjustment can be favorable or unfavorable. For MGAs, the optimum withdrawal/surrender fees are reflected in the complying with table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later7%6%5%4%3%2%1%0%Like a deposit slip, at the expiry of the assurance, the buildup amount can be restored at the business's brand-new MGA rate.

Best Books On Annuities

Unlike excess rate of interest annuities, the quantity of excess interest to be credited is not known until completion of the year and there are normally no partial credit scores throughout the year. Nevertheless, the technique for identifying the excess rate of interest under an EIA is identified ahead of time. For an EIA, it is essential that you know the indexing features made use of to establish such excess rate of interest.

You must likewise recognize that the minimum floor for an EIA varies from the minimal floor for an excess rate of interest annuity - best variable annuity companies (variable annuity with income rider). In an EIA, the flooring is based upon an account value that may credit a lower minimal interest rate and might not credit excess interest every year. Furthermore, the optimum withdrawal/surrender fees for an EIA are stated in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year 10Year 11 and Later10%10%10%9%8%7%6%5%4%3%0% A non-guaranteed index annuity, likewise typically described as a structured annuity, signed up index linked annuity (RILA), barrier annuity or floor annuity, is a buildup annuity in which the account value increases or decreases as established by a formula based upon an exterior index, such as the S&P 500

The appropriation of the quantities paid into the contract is generally elected by the proprietor and may be changed by the proprietor, subject to any kind of contractual transfer limitations. The complying with are essential features of and factors to consider in buying variable annuities: The contract owner bears the financial investment danger related to assets held in a separate account (or sub account).

Withdrawals from a variable annuity may go through a withdrawal/surrender fee. You should know the size of the charge and the length of the surrender cost duration. Starting with annuities sold in 2024, the maximum withdrawal/surrender fees for variable annuities are set forth in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later8%8%7%6%5%4%3%0%Request a copy of the syllabus.

Annuity Conversion

The majority of variable annuities include a fatality benefit equivalent to the better of the account worth, the costs paid or the greatest anniversary account worth - annuities are often purchased for. Several variable annuity agreements use assured living benefits that provide an assured minimum account, revenue or withdrawal advantage. For variable annuities with such ensured benefits, customers need to be mindful of the fees for such advantage guarantees as well as any kind of limitation or limitation on financial investments alternatives and transfer civil liberties

For taken care of delayed annuities, the bonus offer price is contributed to the rate of interest rate proclaimed for the initial agreement year. Know exactly how long the bonus offer rate will certainly be attributed, the rates of interest to be attributed after such incentive price period and any added fees attributable to such bonus offer, such as any greater surrender or mortality and expense charges, a longer abandonment cost period, or if it is a variable annuity, it might have a benefit regain cost upon fatality of the annuitant.

In New york city, agents are needed to supply you with comparison types to aid you decide whether the replacement is in your benefit. Know the effects of replacement (new surrender fee and contestability period) and be sure that the brand-new product fits your existing requirements. Watch out for changing a deferred annuity that could be annuitized with a prompt annuity without comparing the annuity payments of both, and of changing an existing agreement only to obtain a bonus on one more product.

Sell Annuity For Cash

Income taxes on passion and investment earnings in deferred annuities are deferred. In general, a partial withdrawal or surrender from an annuity before the proprietor gets to age 59 is subject to a 10% tax obligation fine.

Normally, claims under a variable annuity contract would be pleased out of such separate account possessions. See to it that the agreement you choose is ideal for your scenarios. If you buy a tax obligation competent annuity, minimal circulations from the agreement are required when you get to age 73. You should understand the impact of minimum distribution withdrawals on the guarantees and advantages under the agreement.

Are Annuities A Good Investment Now

Only purchase annuity products that match your requirements and goals which are appropriate for your monetary and family circumstances. Make certain that the agent or broker is licensed in great standing with the New York State Department of Financial Providers. guaranteed income contracts. The Division of Financial Solutions has actually taken on guidelines needing representatives and brokers to act in your best rate of interests when making referrals to you pertaining to the sale of life insurance and annuity items

Be careful of a representative who recommends that you authorize an application outside New York to purchase a non-New York product. Annuity products authorized available for sale in New York usually provide better consumer securities than items offered elsewhere. The minimum account values are greater, charges are reduced, and annuity repayments and survivor benefit are much more favorable.

Are Life Insurance Annuities A Good Investment

Hi there, Stan, The Annuity Man, America's annuity agent, accredited in all 50 states. The concern today is a truly excellent one. Are annuities truly guaranteed, Stan, The Annuity Male? You discuss contractual guarantees all the time. You speak about warranties, ensure this, warranty that. Are they actually guaranteed, and how are they guaranteed? Please tell us that Stan, The Annuity Guy.

All right, so allow's get down to the fundamentals. Annuities are released by life insurance policy firms. Life insurance coverage business provide annuities of all types. Remember, there are several kinds of annuities. Not all annuities misbehave available, you haters. You currently have one, with Social Safety, you could have 2 if you have a pension plan, but there are various annuity kinds.

Currently I have a pair of different means I look at that when we're purchasing different annuity types. If we're buying a lifetime income stream, we're actually weding that item, M-A-R-R-Y-I-N-G.

Typically, that's mosting likely to be A, A plus, A dual plus, or better (annuity solutions). I take it on a case-by-case circumstance, and I represent virtually every provider around, so we're pricing estimate all carriers for the greatest contractual warranty. Currently if you're looking for primary protection and we're considering a specific time period, like a Multi-Year Guaranteed Annuity, which is the annuity sector's variation of the CD, we're not marrying them, we're dating them

Corporate Annuity

After that duration, we will certainly either roll it to one more MYGA, send you the cash back, or send it back to the IRA where it came from. Lifetime revenue, weding the company.

As long as you're taking a breath, they're going to be there. Rates of interest, MYGAs, dating them. There could be a situation with MYGAS where we're buying B double plus providers or A minus service providers for that duration since we've looked under the hood and regarded it ideal that they can back up the insurance claim.

Table of Contents

Latest Posts

Decoding How Investment Plans Work A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Right Financial Str

Decoding Fixed Index Annuity Vs Variable Annuity Key Insights on Your Financial Future What Is the Best Retirement Option? Benefits of Deferred Annuity Vs Variable Annuity Why Variable Annuity Vs Fixe

Exploring Immediate Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Fixed

More

Latest Posts